Get This Report about Bank Draft Meaning

Wiki Article

Some Known Factual Statements About Bank Statement

Table of ContentsBank Things To Know Before You Buy8 Easy Facts About Bank Statement ShownLittle Known Questions About Bank Certificate.Banking - QuestionsBank Reconciliation Fundamentals Explained

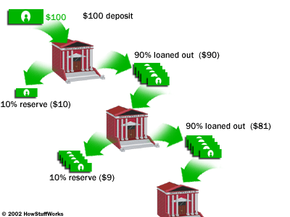

When a bank is perceivedrightly or wronglyto have troubles, clients, fearing that they might lose their down payments, may withdraw their funds so quick that the little section of liquid possessions a financial institution holds becomes swiftly tired. Throughout such a "operate on deposits" a financial institution may have to market other longer-term as well as less fluid properties, commonly muddle-headed, to fulfill the withdrawal needs.

Regulators have broad powers to intervene in distressed banks to reduce interruptions. Financial institutions are currently called for to hold even more and higher-quality equityfor example, in the form of maintained incomes as well as paid-in capitalto barrier losses than they were before the financial dilemma.

Some Known Facts About Bank Code.

A bank is an economic establishment authorized to offer service alternatives for customers that want to conserve, obtain or accumulate even more cash. Banks normally approve down payments from, and also offer fundings to, their consumers. Can assist you obtain funds without a bank checking account.While financial institutions might supply comparable monetary services as credit score unions, financial institutions are for-profit organizations that route many of their monetary returns to their shareholders. That means that they are much less likely to offer you the best feasible terms on a finance or a financial savings account.

Those debtors then pay the funding back to the bank, with interest, over a set time (bank account number). As the customers pay off their loans, the bank pays a portion of the paid rate of interest to its account holders for permitting it to utilize the deposited cash for issued lendings. To further your personal and organization rate of interests, banks supply a large selection of monetary services, each with its very own positives and negatives depending on what your cash motivations are as well as just how they may advance.

Bank Definition Fundamentals Explained

are financial savings items that also include checking account features, like debit card deals. are containers held in a safe center, like a bank safe, where a key owner can position and also get rid of important objects like fashion jewelry or essential files. Banks are not one-size-fits-all operations. Various types of clients will find that some banks are much better economic partners for their goals and also demands than others.The Federal Reserve regulates various other financial institutions based in the U.S., although it is not the only government firm that does so. Area financial institutions have less possessions due to the fact that they are inapplicable to a major copyright, yet they supply monetary services throughout a smaller sized geographical footprint, like best site a county or area.

Online banks do not have physical locations yet often tend to supply much better rate of interest rates on fundings or accounts than banks with physical areas. Deals with these online-only organizations typically occur over an internet site or mobile app and also thus are best for a person who does not call for in-person support and also fits with doing a lot of their financial digitally.

What Does Bank Definition Do?

Unless you prepare to stash your money under your bed mattress, you will ultimately require to engage with an economic establishment that can secure your cash or problem you a financing. While a financial institution might not be the organization you ultimately select for your financial needs, understanding how they run as well as the solutions they can provide can aid you determine what to look for when making your choice.Larger financial institutions will likely have a collection of brick-and-mortar branches as well as ATMs in hassle-free areas, in addition to various digital banking offerings. What's the distinction between a bank and also a lending institution? Since banks are for-profit organizations, they tend to offer much less appealing terms for their customers than a lending institution could offer to optimize returns for their investors.

a lengthy raised mass, esp of planet; pile; ridgea incline, as of a hillthe sloping side of any type of hollow in the ground, esp when surrounding a riverthe left financial institution of a river is on a spectator's left looking downstream a raised section, climbing to near the surface area, of the bed of a sea, lake, or river (in combination) sandbank; mudbank the location around the mouth of the shaft of a mine the face of a body of orethe lateral inclination of an airplane regarding its longitudinal axis throughout a turn, Also called: banking, camber, Visit Your URL cant, superelevation a bend on a roadway or on a train, sports, biking, or other track having the outside built more than the within in order to lower the results of centrifugal pressure on vehicles, runners, etc, rounding it at speed as well as in many cases to help with drainagethe padding of a billiard table. bank i thought about this certificate.

The Only Guide to Banking

You'll need to provide a financial institution statement when you use for a financing, data tax obligations, or data for divorce. A financial institution statement is a paper that summarizes your account task over a particular period of time.

Report this wiki page